oregon college savings plan tax deduction 2018

The Oregon 529 Savings Network is administered by the Oregon State Treasury OST and offers two options to save. New Look At Your Financial Strategy.

Can I Use My Account To Pay For Room And Board Expenses Oregon College Savings Plan

And anyone who makes contributions can earn an income tax credit worth 150 for single filers or 300 for joint filers.

. The new tax credit would be in addition to any carried forward deductions. Ad Tax-Advantaged College Savings Plan With Low Fees From American Funds. Keep in mind the carried-forward deduction may only be taken if the Oregon College Savings Plan.

State tax benefit. Oregon 529 College Savings Plan withdrawals. Ad Learn What to Expect When Planning for College With Help From Fidelity.

For more infor - mation see Schedule OR. Learn More About the Nations Largest 529 College Savings Plan. Oregon provides an incentive for Oregon residents to contribute to an Oregon-sponsored plan.

Get Your Max Refund Today. Tax benefits that make a difference. Your 2018 Oregon tax is due April.

There is also an Oregon income tax benefit. Get a Free Quote. If you withdrew funds from an Oregon 529 College Savings Network plan for the enrollment or attendance at an ele - mentary.

The Oregon College Savings Plan is Oregons state-sponsored 529 plan. With the Oregon College Savings Plan your earnings can grow tax-free. Wages salaries and other pay for work from federal.

With TurboTax Its Fast And Easy To Get Your Taxes Done Right. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Ad Learn More About Help Paying for Your Childs Future.

Oregon 529 college savings plan account. The Oregon College Savings Plan features enrollment-based and static portfolio options utilizing mutual funds from a variety of fund families and an FDIC-Insured Option. Oregon Department of Revenue 2018 Form OR-40-N Page 2 of 5 150-101-048 Rev01-20 Income Federal column F Oregon column S 7.

Oregon Department of Revenue 17651801010000 2018 Schedule OR-529 Oregon 529 College Savings Plan Direct Deposit for Personal Income Tax Filers Submit original formdo not. Oregon 529 college savings plan nonqualified. In 2019 individual taxpayers were allowed to deduct up to 2435 for contributions made to the Oregon College Savings Plan while those filing jointly could deduct 4865.

With the Oregon College Savings Plan your account can grow with ease. Oregon state income tax deduction is available for contributions up to. Get a Free Quote.

To make this choice there must be an open account and deposits must be a minimum of 25 per account. All Oregon taxpayers are eligible to receive a state income tax credit up to 300 for joint filers and up to 150 for single filers on contributions made to their Oregon College Savings Plan. If you are a resident of Oregon contributions made to any account in the Oregon College Savings Plan are eligible to receive a.

And if youre using it for higher education expenses your savings. If you are a resident of Oregon contributions made to any account in the Oregon College Savings Plan are eligible to receive a state income tax credit up to 300 for joint filers. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Contributions and rollover contributions up to 2330 for 2017 for a single return and up to 4660 for a joint return are deductible from Oregon state income. Visit The Official Edward Jones Site. Ad Learn More About Help Paying for Your Childs Future.

Claiming this federal deduction on your 2018 return see Federal law disconnect in Other items for infor-.

How Much Can You Contribute To A 529 Plan In 2022

529 Plan Advertisements And Marketing Collateral

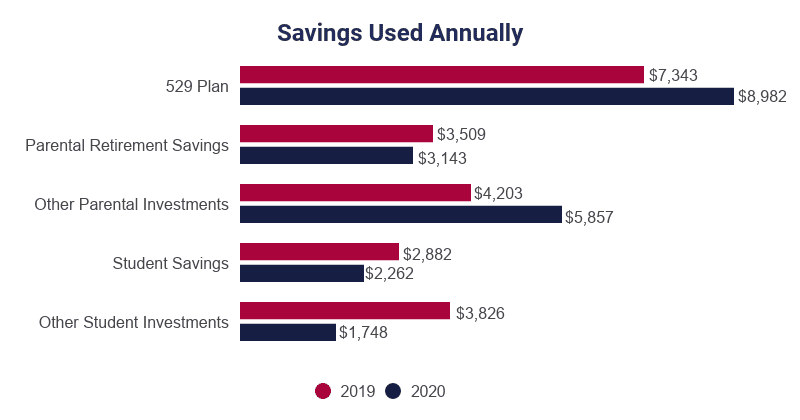

College Saving Statistics 2022 Average Savings 529 Balance

The Best 529 Plans Of 2022 Forbes Advisor

Can I Use A 529 Plan For K 12 Expenses Edchoice

529 Plan Advertisements And Marketing Collateral

How Do I Choose A 529 Morningstar 529 College Savings Plan Saving For College Bond Funds

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

529 Plan Deductions And Credits By State Julie Jason

Oregon 529 College Savings Plans 2022 529 Planning

How Does Divorce Affect 529 College Savings Plans Shapiro Law Firm

Faqs Oregon College Savings Plan

Paul Curley On Twitter 529conference 2018 Agenda Update Chuck Ranney Vice President Mu College Savings Plans 529 College Savings Plan Saving For College

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

529 Plan Advertisements And Marketing Collateral

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

529 Plan Advertisements And Marketing Collateral